Managing and protecting your wealth is more critical than ever. Whether you are an entrepreneur, executive, or part of a multi-generational family with substantial assets, ensuring your finances are secure while also growing them can be challenging.

This is where private wealth management steps in. Private wealth management offers tailored strategies to simplify financial planning, safeguard your assets, and unlock opportunities for consistent growth.

Working with trusted firms like RowanOak Private Wealth enables you to craft a financial strategy tailored precisely to your life goals.

This blog will explore how private wealth management works, its key services, and how it supports asset protection and financial planning while ensuring generational wealth for the future.

The Essentials of Private Wealth Management

What Is Private Wealth Management?

Private wealth management is a personalized financial advisory service designed specifically for high-net-worth individuals (HNWIs) or families. It encompasses a wide range of services, including investment portfolio management, tax strategies, risk mitigation, estate planning, and more.

With a firm like RowanOak Private Wealth, you gain access to a team of experienced advisors who guide every step of your financial decision-making process.

Who Can Benefit from Private Wealth Management?

While private wealth management primarily caters to those with significant financial resources, these services are particularly valuable for individuals who:

- Have complex financial portfolios.

- Want to consolidate financial strategies into a cohesive plan.

- Seek expert advice to mitigate risks and enhance growth opportunities.

With private wealth management, you’re not alone when navigating challenges like economic volatility or intricate tax regulations.

How Private Wealth Management Protects Your Assets

Building a Strong Financial Safeguard

At its core, private wealth management prioritizes asset protection. This involves preparing for unforeseen risks like legal disputes, market downturns, or other disruptions.

Advisors use tools such as trusts, diversified investment strategies, and tailored insurance plans to provide a robust safety net.

Tax Optimization Strategies

Tax obligations can significantly impact your wealth if not handled effectively. Private wealth management includes advanced tax planning to minimize liabilities.

Strategies range from leveraging tax-friendly investment vehicles to structuring income methods to reduce taxable exposure within legal boundaries, preserving as much of your earnings as possible.

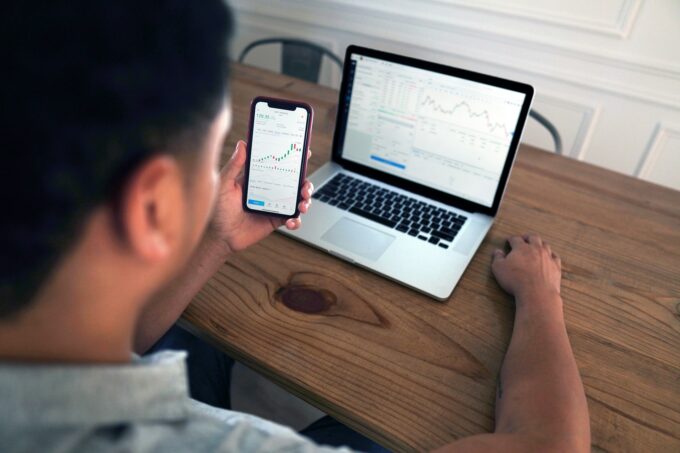

Growing Your Wealth Through Strategic Investments

Diversified Investment Portfolios

A hallmark of professional private wealth management is diversification. Spreading investments across multiple asset classes minimizes risks while optimizing returns.

RowanOak Private Wealth, for example, focuses on bespoke investment strategies aligned with your specific risk tolerance and long-term objectives.

Incorporating Alternative Investments

Beyond traditional asset classes like stocks or bonds, private wealth managers often recommend alternative investments such as real estate, private equities, or venture capital.

These non-traditional options not only hedge risks but also create opportunities for greater returns when thoughtfully incorporated into your portfolio.

Financial Planning Tailored to Your Goals

Customized Goal Setting

Every financial plan begins with your aspirations. Do you want to save for a vacation home? Fund higher education for children or grandchildren?

Or perhaps leave a legacy for the next generation? Private wealth management excels at developing strategies centered around your life goals, ensuring solutions evolve as your priorities shift.

Ongoing Monitoring and Adjustments

Financial markets are dynamic, and so is your life. Professional wealth managers conduct periodic evaluations of your plan and implement adjustments as needed. This active monitoring ensures your financial strategy remains both relevant and effective regardless of evolving circumstances.

Ensuring Generational Wealth

Estate Planning Made Simple

One of the most significant benefits of private wealth management is creating sustainable generational wealth. Estate planning services ensure your wealth is transferred to heirs with minimal tax exposure and is structured to maintain control and privacy.

Supporting Financial Literacy for Heirs

Many wealth management firms also provide financial education programs for your heirs, empowering them to make informed decisions about the inheritance they will eventually manage. This instills confidence and competence in maintaining family wealth.

Join a Community of Like-Minded Individuals

Networking and Exclusive Opportunities

Partnering with a trusted firm like RowanOak Private Wealth doesn’t just provide access to financial experts.

Many management firms foster client networks, enabling meaningful connections with other high-net-worth individuals and families. This network often expands investment opportunities and avenues for collaborative ventures.

Access to Exclusive Perks

From preferred investment opportunities to invitations to exclusive client events, private wealth management supports an elevated experience centered on more than just finances. It’s about enriching your life in meaningful ways while nurturing financial growth.

Take the Next Step Toward Financial Security

Private wealth management is a vital tool for safeguarding your assets, driving financial growth, and building a legacy for generations to come.

With RowanOak Private Wealth as your partner, you’ll have access to expertly crafted financial planning services designed to meet your unique goals and needs. Take the first step toward financial security today. A secure and prosperous future begins with the right financial planning support.