Adhering to the evolving landscape of regulations is one of the most challenging yet critical aspects of running a business. Regulatory compliance isn’t just about avoiding penalties; it’s a key factor in building trust, maintaining credibility, and ensuring sustainable growth.

This post explores how businesses can leverage effective compliance strategies to reduce risks, meet regulatory expectations, and pave the way for long-term success.

Whether you’re a small business or an established corporation, understanding the role of compliance standards and risk management practices can help you thrive in a heavily regulated environment.

Why Regulatory Compliance Is Vital for Modern Businesses

Regulatory compliance goes beyond meeting legal requirements—it’s the foundation of ethical and transparent business operations.

For companies operating in industries like finance, healthcare, and technology, adhering to regulatory policies protects both customers and the organization. By strictly following compliance standards, businesses can:

- Avoid legal penalties and reputational damage.

- Build trust with customers, investors, and stakeholders.

- Enhance operational excellence by identifying areas for improvement.

Organizations like MCS Associates have specialized expertise in helping businesses implement effective compliance strategies. Their solutions ensure companies remain updated and compliant in an environment where regulations are perpetually evolving.

Key Benefits of Implementing Compliance Standards

Meeting compliance standards isn’t just a legal necessity—it offers several competitive advantages. Here are some ways compliance improves overall business performance:

1. Enhances Business Reputation and Trust

Customers and partners are more likely to trust a business that prioritizes ethical practices and abides by industry standards. A strong compliance program demonstrates accountability, making your business a reliable partner in the market.

2. Reduces Operational Risks

Compliance-driven practices include audits and reporting that minimize financial, operational, and reputational risks. By integrating risk management into compliance strategies, businesses can proactively address potential violations and ensure smoother operations.

3. Strengthens Financial Performance

Compliance ensures organizations avoid fines, penalties, or losses caused by internal fraud. Additionally, adhering to regulatory standards can open doors for revenue-building partnerships and customers who expect ethical business behavior.

4. Attracts Investment Opportunities

Investors value companies with transparent policies. Demonstrating adherence to regulatory obligations indicates long-term security and profitability, making your business a more attractive investment opportunity.

The Link Between Risk Management and Compliance

Risk management and regulatory compliance go hand in hand. While compliance focuses on maintaining legal and ethical business practices, risk management evaluates potential threats and identifies strategies to mitigate them.

Effective risk management provides businesses with the insight needed to ensure compliance standards are met. Consider the following elements of a strong risk management framework:

Risk Assessments

Periodic assessments are essential to identify vulnerabilities within key processes. This helps businesses prepare for unexpected risks and align their approach to current regulatory policies.

Monitoring and Reporting

Timely reporting identifies non-compliance issues and allows organizations to resolve them proactively. By implementing monitoring tools, companies can remain informed about potential violations in real-time.

Employee Training Programs

Employees play a central role in compliance and risk management. Regular training ensures that teams are well-versed in regulatory standards specific to their industry.

Staying Ahead of Regulatory Policies

With regulatory guidelines constantly adapting to market changes and technological advancements, staying compliant feels like a moving target. The key lies in being proactive rather than reactive:

Engage with Experts

Consulting firms like MCS Associates offer the expertise needed to align business operations with regulatory frameworks tailored to your industry. Working with experts ensures a smooth transition to changing policies.

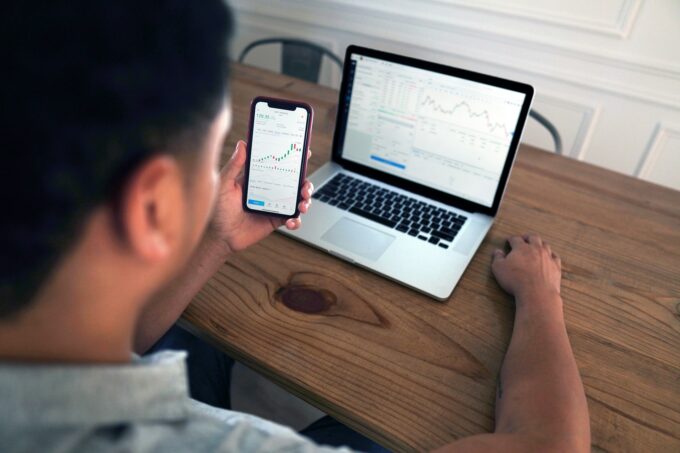

Utilize Technology

Leverage compliance management software to automate manual processes and reduce errors. These tools can help monitor regulatory updates and assist in documentation to meet compliance needs effectively.

Regularly Audit Policies

Monthly or quarterly policy audits ensure internal processes align with updated regulations. Engaging external auditors provides an unbiased review of your systems.

Role of Technology in Compliance Management

Technology has revolutionized the way businesses approach compliance. Relying on manual processes or outdated systems restricts a company from addressing modern compliance challenges effectively. Here’s how technology helps:

AI-Powered Compliance Platforms

Advanced technologies like artificial intelligence (AI) streamline compliance tasks, enabling businesses to analyze large volumes of data quickly. AI can identify irregularities, prevent fraud, and monitor adherence to compliance standards.

Cloud Solutions for Documentation and Security

Cloud-based tools centralize compliance documents, making it easier to access or share them when needed. They also offer enhanced security, ensuring sensitive data remains protected in line with regulatory requirements.

Real-Time Analytics

Technology provides real-time updates and insights that enable organizations to adjust their compliance practices to stay ahead of emerging regulations.

Building a Culture of Compliance

Compliance isn’t a one-time project—it’s a culture that organizations must nurture from the top down. When leaders prioritize compliance, employees adopt the same ethics. Steps to build a compliance-focused culture include:

Leadership Commitment

Leaders should actively demonstrate commitment to compliance by integrating it into their decision-making processes.

Transparent Communication

Clearly articulate the importance of compliance and how it impacts each individual within the organization. Maintain open channels for employees to report potential concerns safely.

Incentivize Ethical Behavior

Recognize and reward teams or individuals who focus on compliance and risk management, reinforcing its importance to your company’s success.

Future Trends in Regulatory Compliance

Regulatory expectations are evolving alongside advancements in technology and societal needs. Here’s what businesses can prepare for in the future:

- Sustainability Regulations: Governments will emphasize environmental sustainability, demanding stricter adherence to eco-friendly practices.

- Data Protection Laws: The rise of AI and Big Data will lead to tighter regulations on privacy and data handling.

- Global Compliance Standards: With businesses expanding globally, adhering to international regulatory frameworks will become vital.

Being future-ready involves reassessing current policies and seeking expert guidance to align business goals with evolving compliance trends.

Building Success Through Compliance

Achieving compliance is about more than just avoiding penalties—it’s a strategic asset that drives growth, enhances reputation, and ensures risk management. By focusing on compliance standards alongside proactive risk-reduction strategies, businesses can thrive in a competitive environment.

If you’d like to optimize your compliance approach, MCS Associates provides tailored services to help businesses meet modern regulatory challenges effectively. Whether you’re a startup or an established organization, understanding compliance can be the key to your business success.

Ensure your business remains compliant and competitive—start prioritizing your regulatory framework today!